maryland ev tax credit 2022

You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle. To apply for the tax credit via an online application portal called Jotform please click the link below to start your application.

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Clean Cars Act of 2022.

.jpg)

. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in Hybrid. Current law only authorizes the program through to the end of 2022 however. Annual funding would increase from 6000000 to 12000000 through fiscal year 2023 under the proposal by Governor Larry Hogan.

Organized by the Maryland Department of Transportation MDOT Maryland Energy Administration MEA and Maryland Department of the Environment MDE we enjoy key support from a broad coalition of clean cities supporters including State agencies local and county. When possible please submit applications electronically to avoid mail delays. Up to 26 million allocated for each fiscal year 2021 2022 2023.

Additional funding may extend the program. Altering for certain fiscal years the vehicle excise tax credit for the purchase of certain electric vehicles. If you have mailed in your application we ask that you contact us via phone at 410-537-4000 or 1-800-72-ENERGY or email at DLInfo_MEAmarylandgov to confirm receipt.

This is about 48 percent of the total tax credit allowance for Tax Year 2022. The Clean Cars Act of 2020 proposes to increase the funding for the Maryland electric vehicle excise tax credit. Staff will confirm receipt of electronic applications within one to two business days via email.

Maryland citizens and businesses that purchase or lease these vehicles. The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids. Yes there is a Maryland EV tax credit for electric vehicles as well as a home charger rebate incentive.

Decreasing from 63000 to 50000 for purposes of. The total amount of funding currently available for this rebate program in state fiscal year FY 2022 7122- 63023 is up to 1800000. 1500 tax credit for each plug-in hybrid electric vehicle purchased.

House Bill 696 establishes a 3-year electric school bus pilot program to begin transitioning Marylands 7300 school buses from diesel to electric buses. Decreasing from 63000 to 50000 for purposes of the electric. Funding is currently depleted for this Fiscal Year.

If the credit is more than the state tax liability the unused credit may not be carried forward to any other tax year. If you have mailed in your application we ask that you contact us via phone at 410-537-4000 or 1-800-72-ENERGY or email at DLInfo_MEAmarylandgov to confirm receipt. The rebate is up to 700 for.

Maryland offers a rebate of 40 of the cost of Electric Vehicle Charging Equipment and Installation. The Maryland Energy Administration MEA has opened the application period for the Tax Year 2022 TY 2022 Maryland Energy Storage Income Tax Credit Program. When possible please submit applications electronically to avoid mail delays.

Maryland EV Tax Credit Status as of June 2020. Would apply to new vehicles purchased on or after July 1 2017 but before July 1 2023. Electric vehicle excise tax credit the limitation on the maximum total purchase price 6 of certain electric vehicles.

Effective July 1 2023 through June 30 2027 an individual may be entitled to receive an excise tax credit on a qualifying zero-emission plug-in electric or fuel cell electric vehicle regardless of whether you own or lease the vehicle. This tax credit covers solar batteries and is a 30 personal income tax credit up to 5000. President Bidens EV tax credit builds on top of the.

Altering for certain fiscal years the vehicle excise tax credit for the purchase of certain electric vehicles. This program is designed to encourage the deployment of energy storage systems in Maryland. Establishing the Medium-Duty and Heavy-Duty Zero-Emission Vehicle Grant Program for certain vehicles and equipment to be administered by the Maryland Energy Administration.

State sales tax exemptions in Maryland. Qualified Two-Wheeled Plug-In Electric Drive Motor Vehicle Tax Credit. Reference Public Law 116-260 Public Law 116-94 Public Law 115-123 Public Law 114-113 and 26 US.

Residential and commercial taxpayers can apply for the tax credit on a first-come first-served basis. Electric car buyers can receive a federal tax credit worth 2500 to 7500. January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car.

Staff will confirm receipt of electronic applications within one to two business days via email. January 22 2020 Lanny. Tax credits depend on the size of the vehicle and the capacity of its battery.

Maryland EV is an electric vehicle education and outreach resource serving Maryland and the Mid-Atlantic. The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the amount of the State income tax liability. Establishing the Medium-Duty and Heavy-Duty Zero-Emission Vehicle Grant Program for certain vehicles and equipment to be administered by the Maryland Energy Administration.

ECPG funding is available for up to. The credit ranges from 150 to 3000 depending on the vehicles battery size the larger the battery the higher the credit. 3000 tax credit for each plug-in or fuel cell electric vehicle purchased.

Plug-In Electric Vehicle Credit website and IRS Form 8936 which is available on the IRS Forms and Publications website. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. The Maryland Energy Administration MEA has opened the application period for the Tax Year 2022 TY 2022 Maryland Energy Storage Income Tax Credit Program.

Maryland Launches Tax Year 2022 Energy Storage Income Tax Credit. As of July 12 2022 the program has a total of 362916 available for energy storage tax credit certificates. The tax credit is available for all electric vehicles regardless of make or model and can be used to purchase the vehicle or lease it.

Applicants are encouraged to thoroughly review the FY23 EVSE Rebate Program Funding Opportunity Announcement FOA below.

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Arcimoto Vehicles Reclassified As Autocycles In The State

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

.jpg)

Latest On Tesla Ev Tax Credit July 2022

Arcimoto Vehicles Reclassified As Autocycles In The State Of Maryland Ultra Efficient Electric Vehicles

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

-FI.jpg?t=1643691990&width=696)

Report Evs At Price Parity With Ice Vehicles In 2022 Rto Insider

2022 Ev Tax Credits In Maryland Pohanka Automotive Group

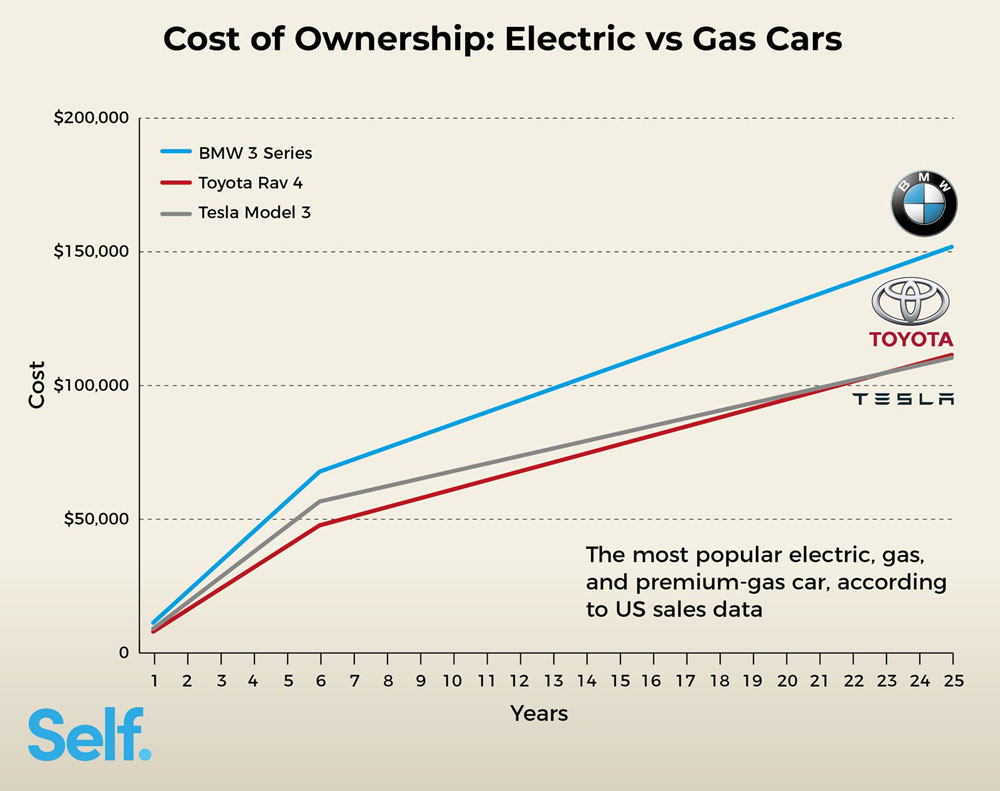

Electric Cars Vs Gas Cars Cost In Each State Self Financial

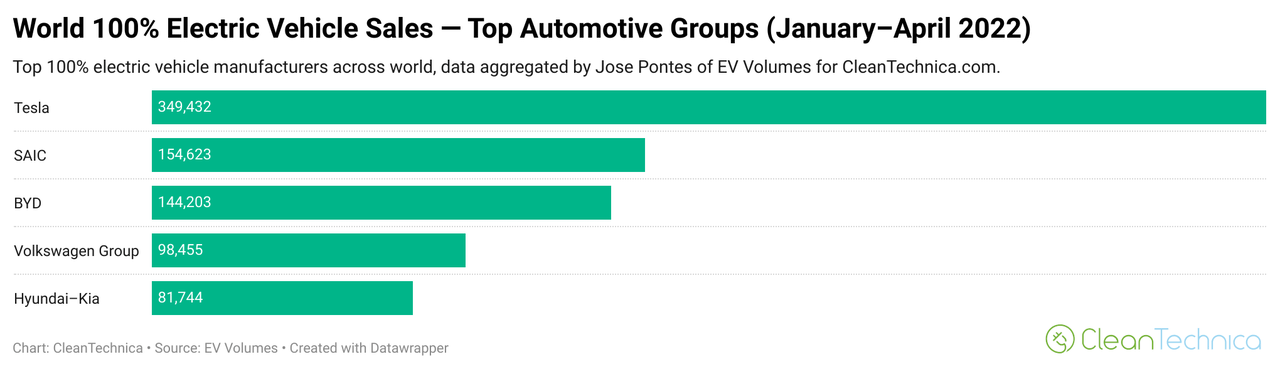

Ev Company News For The Month Of May 2022 Seeking Alpha

Ev Tax Credit Calculator Forbes Wheels

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Electric Vehicle Legislation 2022 Pluginsites

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Electric Vehicle Legislation 2022 Pluginsites